kern county tax collector payment center

Payments can be made online at wwwkcttccokerncaus. File an Exemption or Exclusion.

Make a payment on a traffic criminal or juvenile dependency case that was previously set up on a payment plan.

. Assessment Roll is delivered by the Assessor to the Auditor-Controller. Kern County real property taxes are due by 5 pm. You can mail your payments to the Kern County treasurer and tax collector at.

Child Abuse or Neglect. Box 541004 Los Angeles CA 90054-1004. Kern County CA Home Menu.

Enter a 10 or 11 digit ATN number with or without the dashes. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. Change a Mailing Address Kern County Assessor-Recorder.

The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. Kern County Tax Collector Address. KCTTC Payment Center PO.

Box 541004 Los Angeles CA 90054-1004. If your tax bill is not available please provide your Assessor Tax Number or an adequate legal description along with your payment. The various payment methods available include mailing a check cash or money order to the KCTTC payment center PO.

Search for Recorded Documents or Maps. Kaufman said the extension is due to the fact that county buildings will be closed to the public through May 1. You can also pay online.

Assessors Map Search. Press enter or click to play code. Tax payments only must be mailed to.

How to Avoid Penalties. Fraud Waste and Abuse in Kern County Government. Box 541004 Los Angeles CA 90054.

Credit cards and debit cards have a 2 card processing fee based on the amount of taxes paid. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged. 1 Via mail to.

The April 10 property tax deadline has been extended to May 4 due to the coronavirus outbreak according to the Kern County Treasurer-Tax Collector Jordan Kaufman. Purchase a Birth Death or Marriage Certificate. The various payment methods available include mailing a check cash or money order to the kcttc payment center po.

Change a Mailing Address. To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before the due date. KCTTC Payment Center PO.

Crime Non-Emergency Domestic Violence. Via the Treasurer-Tax Collectors website at wwwkcttccokerncaus. The Kern County Treasurer and Tax Collectors Office is part of the Kern County Finance Department that encompasses all financial functions of the local government.

The release outlined three primary methods of payment. KCTTC Payment Center PO. The 2 processing fee is the same whether you pay on-line or in person.

File an Assessment Appeal. Last day to pay unsecured taxes without penalty. Via the Treasurer-Tax Collectors website at wwwkcttccokerncaus Electronic Checks ACH can be used for on-line payments with zero fees.

1 Pay online. They can also be mailed to. Property tax payment deadline moved to May county says.

Box 541004 Los Angeles CA 90054-1004 or via the treasure-tax collectors. Property Taxes - Pay Online. Box 541004 Los Angeles CA 90054-1004.

Do not include correspondence with your payment. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Electronic Checks ACH can be used for on-line payments with zero fees.

Please type the text from the image. Fraud waste and abuse in kern county government. Kerr County Tax Office 700 Main Street Suite 124 Kerrville Texas 78028 Phone.

Your new Tax Bill Explained. Find Property Assessment Data Maps. 3 Via the treasurer-tax collectors website at wwwkcttccokerncaus.

First day to file assessment appeals for the regular rolllien date assessments. Box 541004 Los Angeles CA 90054-1004. Request a Value Review.

Get Information on Supplemental Assessments. Credit cards and debit cards have a 2 card processing fee based on the amount of taxes paid. Due to COVID-19 the public is encouraged to obtain a money order and mail it to the address above to avoid in-person payments.

The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. Property Taxes - Pay by Wire. Correspondence must include the Assessor Tax Number.

Payments can be made on this website or mailed to our payment processing center at PO. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real property tax payments.

Jordan Kaufman Kern County Treasurer Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

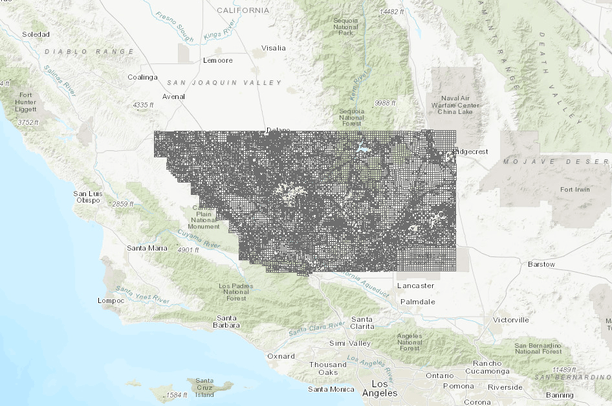

Parcels 2019 Kern County Data Basin

Treasurer More Than 19 Million Stolen From Schools News Bakersfield Com

Advisory Council Kern County Sheriff S Department California Sun Badge Police Badge Money Notes Money Poster

Jordan Kaufman Kern County Treasurer Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Assessor Recorder S Office Facebook

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

Property Tax Payment Due On By Dec 10 News Taftmidwaydriller Com

About The Grand Jury Kern County Ca

Jordan Kaufman Kern County Treasurer Tax Collector

Events Kern County Taxpayers Association

Kern Public Works Releases List Of October Waste Collection Events Kget 17